How Would Greek Default Affect US Stocks?

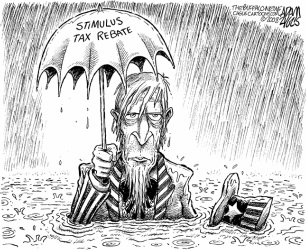

Greek default would clearly bring bad news for the US, and the rest of the world, but how extensive would the damage be? Are stocks going to drop and penny stocks completely crumble? Experts are too fearful to make any predictions about what will happen after Greece goes under, but across the board, politicians and economists all agree that the default is nearly unavoidable.

Stuck in a terrible recession which is causing addition tax problems, Greece is worse for wear than ever. Trying to put together massive job reduction, tax increases and budget cuts everywhere and anywhere they can, the country's top economists are doing everything in they power to get the much needed EU bail out approval.

But is it too late?

Most major financial news sources agree, Greece is too deep in to be saved. The Greek debt, though not absolutely terrible is becoming unmanagable and the chances of a bail out are growing weaker and weaker with every EU meeting.

While the 300 billion euro in outstanding debt that Greece holds is not likely going to change the world economy, it may trigger a more serious problem. Greece's worry some neighbors and major trading partners, Italy, Turkey and Spain are all feeling the pressure of the Greek default. With massive outstanding debt of their own, especially Spain and Italy are causing a lot of trouble for the US and the world. Ad important, and reliable trading partners, and essential members of the EU, Italy and Spain are now said to have a 25-66% chance of a future default, which could lead to massive crisis for the RU, and therefore for the US.

However, there is some hope. Though the default is unavoidable, it is "controllabe". According to zerohedge and CNNMoney the Dutch ,German and the British ministries have all decided to use their well capitalized and prepared banks to manage stocks, penny stocks and control the situation in Europe.